Software as a Service (SaaS) is one of the fastest-growing divisions in the IT industry. SaaS models, which are centrally located on a remote cloud network, operate on a subscription basis and become useful for many businesses due to their flexibility, cost, and many other reasons.

Newsdata.io is just another example of Saas-based product, which in this case is a news API that users use to get required news data through API calls. This is just one simple example of Saas.

In the coming period due to the covid pandemic, many companies will need the remote working of their employees, so the need for SaaS will only increase. In this article, I’ve included some of the most important trends and growth data for SaaS solutions in 2022.

SaaS spending vs overall IT spending

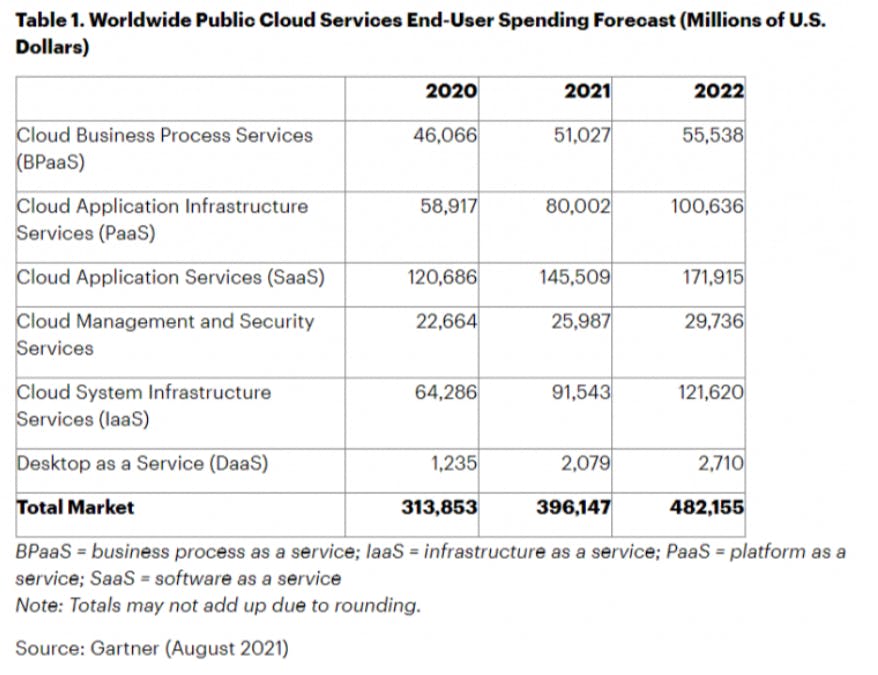

Despite the fact that the epidemic has affected many businesses and economies around the world this year, cloud growth has always skyrocketed. Gartner also adds that end-user spending on public cloud services is expected to reach $ 396 billion in 2021. It also has the potential to grow to 21.7% in 2022.

Gartner senior research director said Henrique Cecci. “The economic, organizational, and social impact of the pandemic will continue to act as a catalyst for digital innovation and adoption of cloud services. This is especially true for use cases such as collaboration, remote working, and new digital services to support a hybrid workforce. “

Cloud growth: SaaS vs other cloud services

Compared to other cloud choices, SaaS offers more functionality. As more companies adopt SaaS solutions for a wide range of business operations, well beyond the original SaaS areas of core engineering and sales applications, the total growth of the SaaS market will increase. over the next few years.

Compared to other cloud services, SaaS has a substantial advantage because it is the first fully successful cloud service. According to Gartner, SaaS will continue to dominate the market until 2022.

However, compared to other cloud services such as Platform as a Service (PaaS) and Infrastructure as a Service (IaaS), both expected to double in ‘By 2020 alone, the growth rate of SaaS is slowing.

Largest SaaS companies

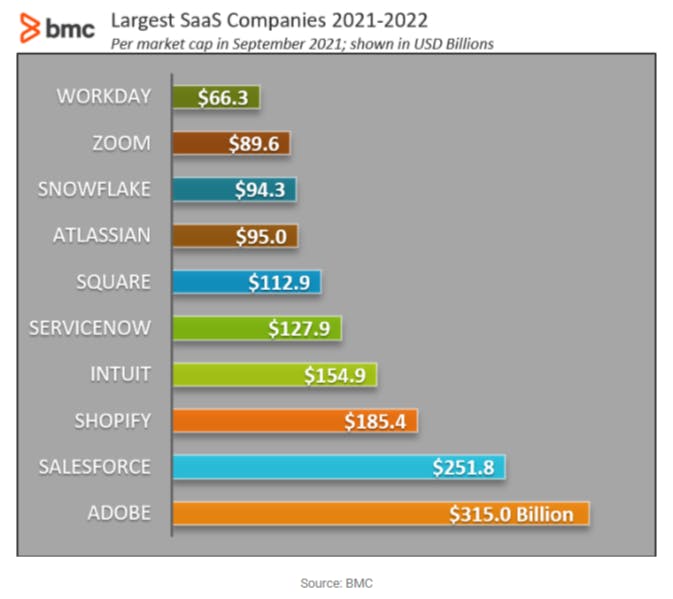

Let’s look at the 10 largest publicly owned SaaS companies per market cap in the first half of the year 2021.

If you compare the growth of these companies with similar numbers since 2020, it turns out that it has increased. For example:

Salesforce’s valuation in January 2021 was $ 161 billion compared to $ 251 billion in September 2021.

Additionally, Shopify has grown from $ 52.1 billion in 2020 to over $ 185 billion dollars today. That’s 225% growth in 20 months!

Microsoft and Oracle are missing from this list. They are large IT companies but calling them SaaS providers is incorrect because on-premise software sales are a big part of their business.

Giant companies are under pressure to rapidly migrate their software solutions to a SaaS consumption model due to the desire for subscription-based pricing structures. The total cost of ownership (TCO) of SaaS solutions is comparable to on-premises software implementation strategies. This suggests that SaaS solutions have a lot of room to grow in the years to come.

As an increasing number of customers can benefit from the same product features through the subscription pricing model, large enterprise software companies such as Oracle, Microsoft, SAP, and IBM are expected to maintain their market share for software products.

SaaS acquisitions & IPOs

Entrepreneurs, inventors, and companies have been motivated to create new SaaS solutions due to the stable economy and investor interest in scalable cloud solutions. daily, as large organizations seek out the next big SaaS news.

SaaS acquisitions in 2021

Dropbox acquired Docsend for $ 165 million. Docsend provides a secure and reliable interface for users to share and track their documents.

Kenna Security, a global leader in risk-based vulnerability management, has been acquired by Cisco.

In July, ZoomInfo paid $ 575 million for chorus.ai. Chorus.ai is a leader in conversational intelligence.

Panasonic Corporation has acquired Blue Yonder, a global provider of end-to-end digital distribution platforms.

Recent SaaS IPOs

Industry leaders have continued to rely on SaaS solutions due to recent changes in the workplace landscape. Many SaaS companies are in a position to go public in 2021 due to the increase in inactivity. For example, compared to the same period in 2020, the number of companies specializing in SaaS that were the subject of an IPO increased by 125% in 2021.

Couchbase

Couchbase, an expert in NoSQL databases, went public on July 22, and posted a 39% price hike to $ 33.25 a share on day one, valuing the company at over $ 1 billion.

SentinelOne

SentinelOne, a cybersecurity startup, debuted on the stock market on June 30 and closed at $ 42.50 a share, valuing the company at $ 10 billion. The company specializes in endpoint security, SentinelOne uses machine learning to ensure cybersecurity.

Confluent

Confluent, which went public on June 23, closed the day at $ 36 a share, valuing the company at $ 9 billion. The popular open-source Kafka streaming data platform is available in an enterprise edition from the company.

Sprinklr

At the time of its IPO in June, Sprinklr was valued at $ 4 billion at $ 16 per share. Sprinklr is a software company that develops content marketing, advertising, and media management solutions used by some of the world’s most famous companies.

SaaS adoption & workforce size

The growth of SaaS can also be measured in terms of adoption. Are customers using the same number of SaaS products, fewer or the same number of SaaS products? While SaaS was initially ideal for small businesses and startups, SaaS is now an accepted and affordable alternative that enables flexibility and digitization for businesses of all sizes. In conclusion, in recent years the number and types of consumers of SaaS products have increased.

Recent research has shown that:

The growth rate of the SaaS market is approximately 18% per year. 99% of companies will have implemented one or more SaaS solutions by the end of 2021.

Almost 78% of small companies have already invested in the SaaS market.

The use of SaaS in healthcare is currently increasing by 18 years.

Agility and scalability are two of the top reasons to deploy SaaS solutions, according to 70% of CIOs.

Several variables contribute to the relationship between SaaS adoption and workforce size:

Small businesses often focus on a limited number of businesses, requiring a limited number of assets. Users working on separate projects may have their own unique SaaS product requirements as the business grows and the number of teams increases.

To minimize the costs and security risks associated with shadow IT or the use of unauthorized software in the workplace, large organizations are simplifying the provision of all necessary SaaS services.

Users who use a variety of SaaS solutions to meet their technology needs can choose from a variety of products targeting the same audience and the same application use cases, as large-scale enterprise projects are so complicated that no SaaS solution can provide all the required functionality.

Why is SaaS so popular?

Despite their size, established businesses aren’t ignoring SaaS. Instead, they are fully committed to the as a service business model, which enables them to meet a wide range of demands with flexible and up-to-date solutions.

Despite limited IT resources, customers are increasingly choosing the subscription pricing model to meet growing IT needs, especially for small businesses and startups. As a result, there is a favorable competitive landscape, which allows healthy competition among SaaS companies as market demand increases dramatically.

According to a study, the average number of competitors for SaaS companies around 2012 was less than three. At the end of 2017, each SaaS company faced nine other companies in the same market segment. Between 2007 and 2017, the number of products available for SaaS marketing solutions increased from 500 to 8,500. Acquisitions, IPOs, and growth rates all imply that this trend will continue.

SaaS benefits for the customer

SaaS products offer many benefits to customers:

SaaS offers greater strategic value than on-premises software implementations. Software implementation time has been reduced from weeks and days to minutes thanks to the SaaS model.

Users have a diverse collection of resources to meet a variety of demands with an abundance of affordable enterprise SaaS solutions. Due to the many features provided by SaaS solutions that aim to improve the customer experience, companies are seeing increasing levels of staff engagement.

Security updates, bug fixes, and feature enhancements can also be implemented on the fly by SaaS providers. On-premise facilities previously required these capabilities to go through many layers of regulations and corporate controls before reaching end users.

Businesses and software vendors have found it easier to deliver essential functionality and functionality to end users through SaaS technology, which has contributed to the popularity of SaaS solutions over on-premises software products.

Final Thoughts

Ultimately, the rise of SaaS solutions will continue as we go. SaaS is used by both large and small businesses, and as these possibilities expand, this ratio will increase. For more information, see the following articles.

Original article: saasworthy.com/blog/saas-in-2022